Secure Faxing in Finance: Protecting Sensitive Documents in a Digital-First Era

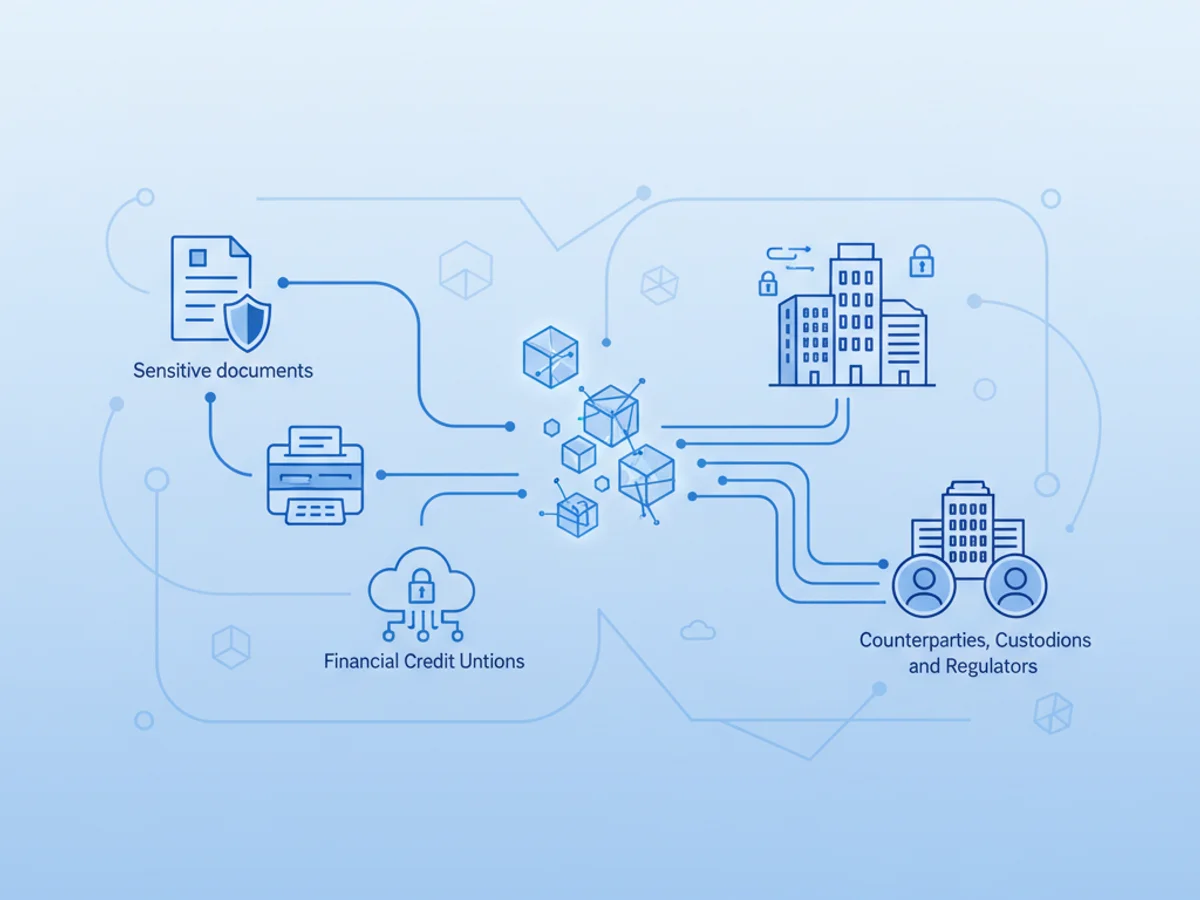

In an industry defined by trust, financial institutions can’t afford gaps in how sensitive documents are sent, received, and archived. While digital portals and encrypted messaging have advanced, faxing remains essential across banking, wealth management, insurance, broker-dealers, and credit unions. Counterparties, custodians, and regulators still rely on fax for time-sensitive, legally binding documents—making secure faxing a critical piece of operational resilience.

Why secure faxing still matters in finance

Faxing persists because it’s interoperable, widely accepted, and auditable. But legacy fax machines and on-prem lines introduce risks that don’t align with modern security standards:

- Paper exposure: Printed pages sitting on shared devices can be viewed, copied, or misfiled.

- Misdials and routing errors: Manual dialing and unclear workflows lead to unintended disclosure.

- Limited auditability: Analog machines offer scant delivery logs and access controls.

- Reliability concerns: The sunsetting of traditional copper phone lines (POTS) reduces the consistency of legacy fax transmissions.

At the same time, regulators expect robust safeguards and documentation around nonpublic personal information (NPI) and other sensitive data. Frameworks and rules often applicable to financial institutions include:

- GLBA (Gramm-Leach-Bliley Act) Safeguards Rule

- SEC Regulation S-P and related guidance

- FINRA supervision expectations

- PCI DSS for any cardholder data involved

- State privacy laws and breach notification requirements

Secure faxing today means bringing fax workflows into a controlled, encrypted, and monitored environment that meets the same bar as other secure communications.

What modern secure faxing entails

Modern, online fax solutions elevate faxing from a peripheral activity to a governed, secure workflow integrated with your broader information security program. Core capabilities of secure online faxing include:

- End-to-end protection: Encryption in transit and at rest, secure web access (HTTPS), and hardened storage.

- Identity and access: Role-based permissions, MFA, SSO, and least-privilege configurations to control who can send, view, and manage faxes.

- Comprehensive logging: Delivery receipts, read receipts, immutable audit trails, and event logs that support investigations and compliance reviews.

- Data handling: Configurable retention policies, legal hold options, and granular deletion to align with records management.

- Workflow automation: OCR and metadata tagging, auto-routing to the right team or queue, and templates for standard documents.

- Recipient controls: Number validation, allowlists, and confirmation steps for high-risk transmissions.

- Operational resilience: High availability, automatic retries, and monitoring to keep critical communications flowing.

For risk and compliance teams, these features support evidence-based oversight: clear ownership, demonstrable controls, and the ability to prove that sensitive data is protected throughout its lifecycle. For operations teams, the payoff is speed, fewer manual errors, and consistent delivery.

How to operationalize secure faxing in your institution

Building a secure fax program is less about replacing one tool and more about defining a controlled, repeatable process. Consider the following blueprint:

- Map data flows: Identify what types of information move via fax (e.g., account transfers, wire instructions, loan documents, claims) and where they originate and land.

- Classify data: Apply labeling (Confidential, Restricted) so faxed content is governed under your information security policies.

- Define policy: Set clear rules for who can fax which documents, approved recipients, required covers or disclaimers, and mandatory checks before sending.

- Strengthen authentication: Use MFA and SSO, and apply role-based access so only authorized users or service accounts can send or retrieve faxes.

- Validate recipients: Implement number verification, allowlists for frequent counterparties, and a second-review step for sensitive transmissions.

- Standardize templates: Use covers with confidentiality notices, sender contact details, and a reference ID for easy tracking.

- Automate routing: Configure queues and tags so incoming faxes go to the right team automatically, reducing manual handling.

- Manage retention: Align storage periods with regulatory requirements and internal policy; apply legal holds when necessary.

- Monitor and audit: Review logs regularly, integrate with SIEM or reporting tools, and test controls during internal audits.

- Plan continuity: Ensure number porting, failover, and backup procedures are documented and tested.

Security best practices to reduce fax-related risk:

- Enforce least privilege: Restrict send/view permissions and admin rights based on job function.

- Train staff: Reinforce procedures for verifying recipient details and handling sensitive content.

- Redact when feasible: Remove unnecessary PII or account data before sending.

- Use secure endpoints: Access fax services from managed devices with updated OS and browser patches.

- Protect notifications: Limit sensitive details in email or SMS alerts about incoming faxes.

- Test regularly: Conduct periodic drills for misdirected faxes, delivery failures, and incident response.

Choosing the right platform is equally important. When evaluating an online fax provider, look for:

- Encryption and secure protocols, with detailed documentation

- Role-based access, MFA, SSO, and granular admin controls

- Robust audit logs and delivery confirmations

- Configurable retention and data deletion options

- Automated routing, OCR, and search features to reduce manual work

- Number porting and reliability measures that support business continuity

- APIs and integrations to embed faxing in your existing workflows and monitoring

A thoughtful combination of technology, policy, and training can transform faxing from a legacy risk into a controlled, efficient channel for sensitive financial communications.

Ready to modernize your secure faxing?

BestFax helps financial institutions move to a secure, online fax workflow without disrupting day-to-day operations. With encryption, role-based permissions, detailed audit trails, flexible retention options, and integrations that fit your stack, BestFax makes it easy to protect sensitive documents while improving speed and visibility. If you’re ready to upgrade, explore BestFax to see how a modern, secure fax platform can support your compliance and operational goals.

Related Posts

Secure Faxing for Legal Documents: Send Files Safely from Any Device (No App Required)

Send secure legal faxes from any device—no app required. Learn best practices and see why BestFax.com is the fast, HIPAA‑compliant solution for firms on the go.

You Don’t Need a Fax Machine Anymore—Here’s the Smarter Way to Fax

You don’t need a fax machine anymore. Send and receive secure, HIPAA‑compliant faxes right from your mobile browser with BestFax.com—no app required.

Fax Compliance for Real Estate: Keep Every Deal Secure (Without Installing an App)

Real estate deals demand secure, compliant faxing. BestFax.com enables HIPAA-grade faxing from any mobile browser—no app needed—so teams stay fast and compliant.